As an importer or CBAM declarant, it is important to understand how to utilize the default values provided by the EU Commission for reporting CBAM’s goods embedded emissions. This short guide will walk you through the process and highlight the steps you need to take.

For the 4th quarter of 2023 CBAM report, which will be submitted by 31 January 2024, you can rely on the default values provided by the EU Commission. These default values are predetermined emission factors that represent the average emissions associated with specific goods. By using these default values, you can simplify the reporting process and ensure compliance with CBAM regulations.

However, it is crucial to note that starting from the 3rd quarter of 2024 CBAM report, the use of default values will no longer be permitted. This means that you will need to collect and report the actual emissions data from your suppliers. To prepare for this transition, it is advisable to start collecting suppliers’ CBAM goods embedded emissions now.

To collect suppliers’ CBAM goods embedded emissions, you can request your suppliers to fill up the CBAM communication template for installation. Your suppliers should collect and calculate the emissions associated with the goods they supply to you. By gathering CBAM communication template for installation from your suppliers in advance, you will be well-prepared for the July 2024 reporting requirements.

CBAM REPORTING GUIDE

Using the CBAM Webinar as a guide, you can follow the steps below to complete your CBAM report for the reporting period of October – December 2023 by 31 January 2024.

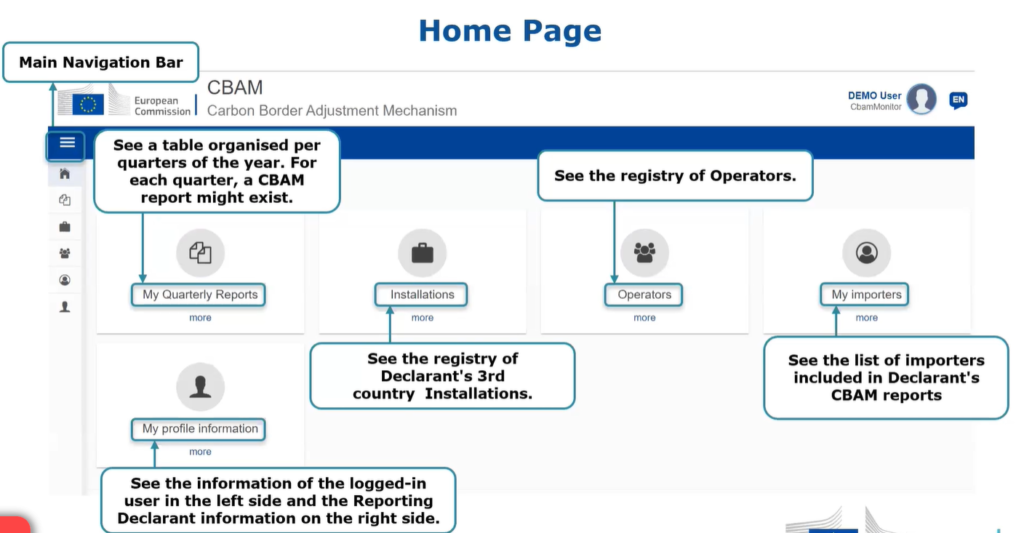

- Once you login as a CBAM declarant for the EU country that you have imported into. You will be able to see the CBAM reporting homepage as below.

2. Click on the My importers and fill the details if you are reporting for your company.

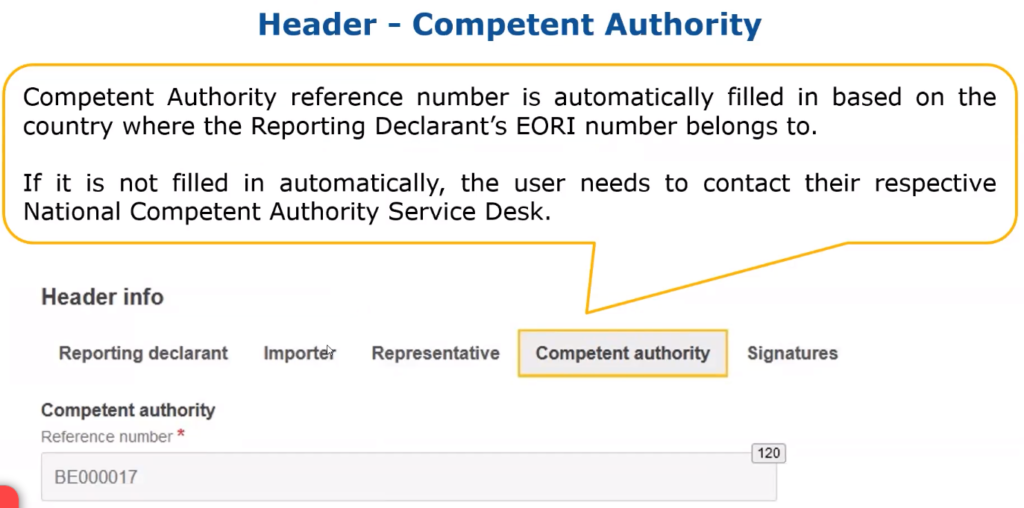

3. Check the Competent Authority tab to see if the reference number is autofilled, if not refer to Provisional list of National Competent Authorities (NCAs) for the Carbon Border Adjustment Mechanism

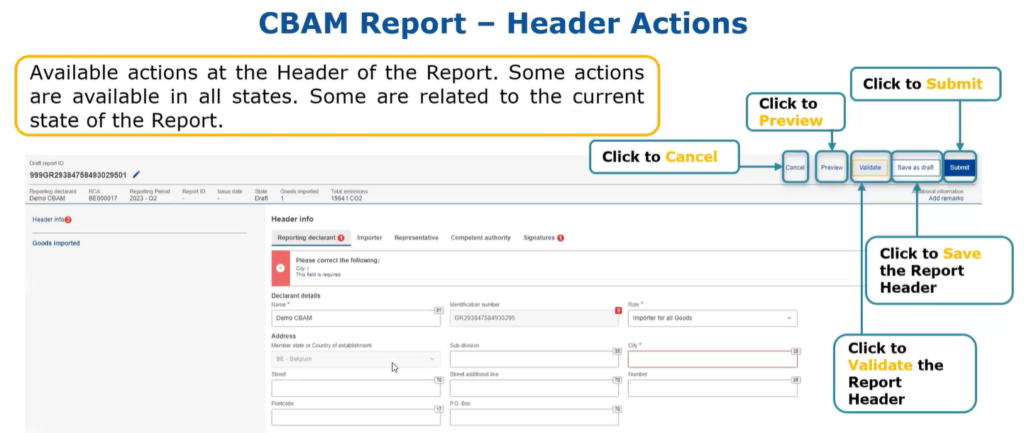

4. Go Homepage and click CBAM Report, fill up Header Info.

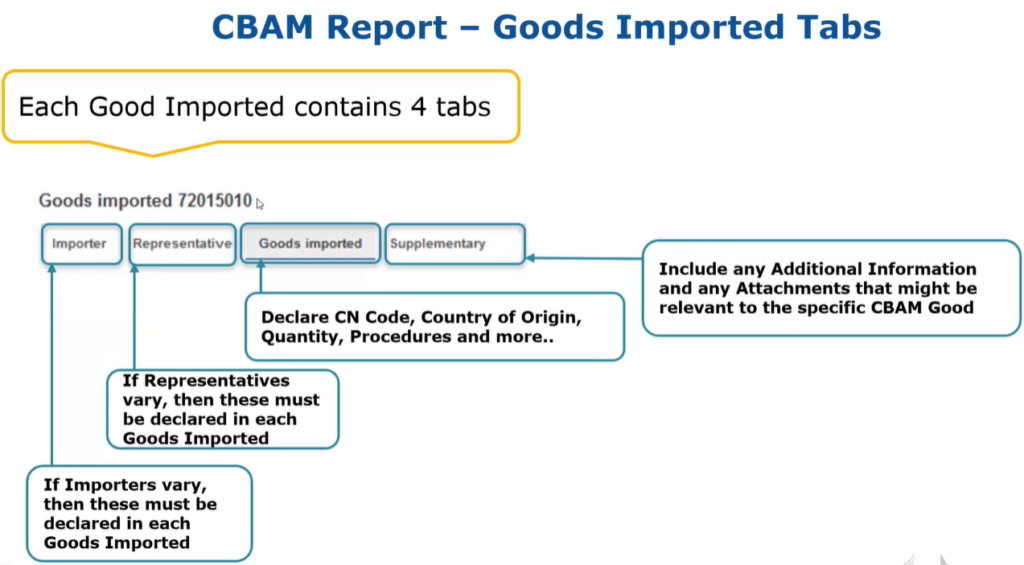

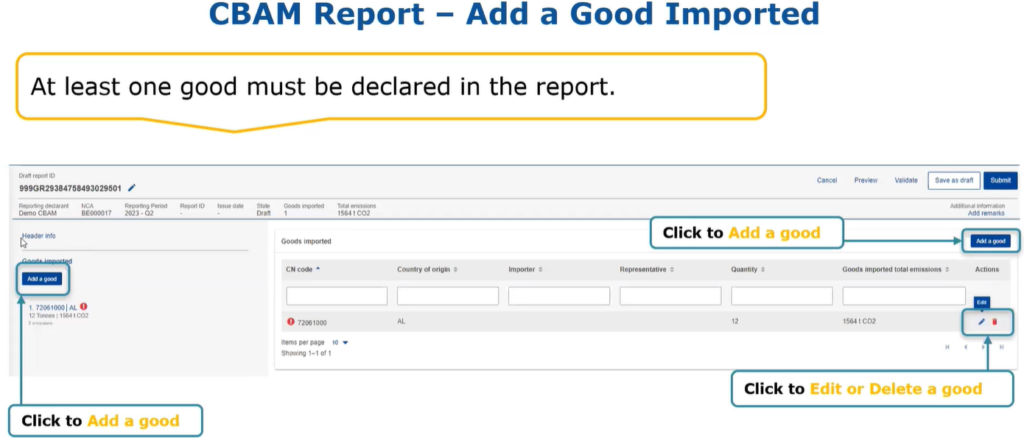

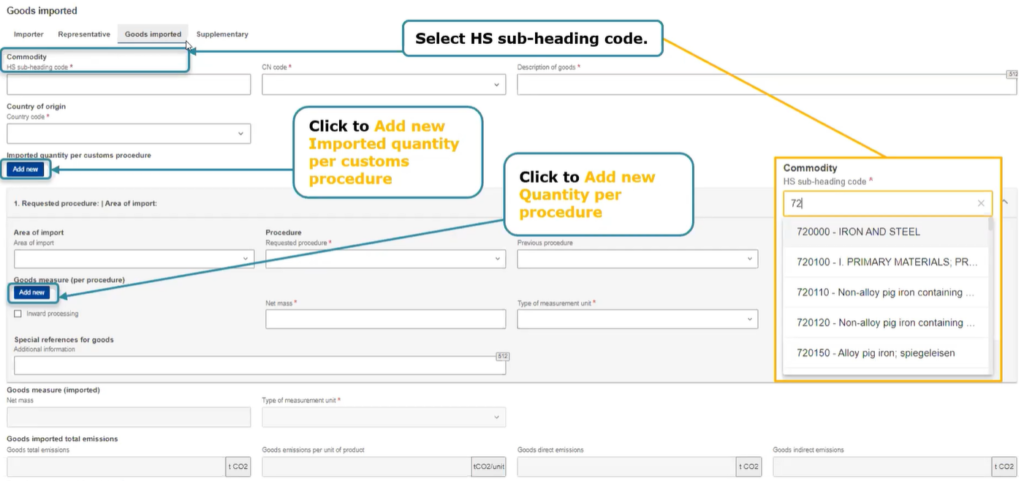

5. Click Goods Imported under the Header Info to declare the goods’ information including CN code.

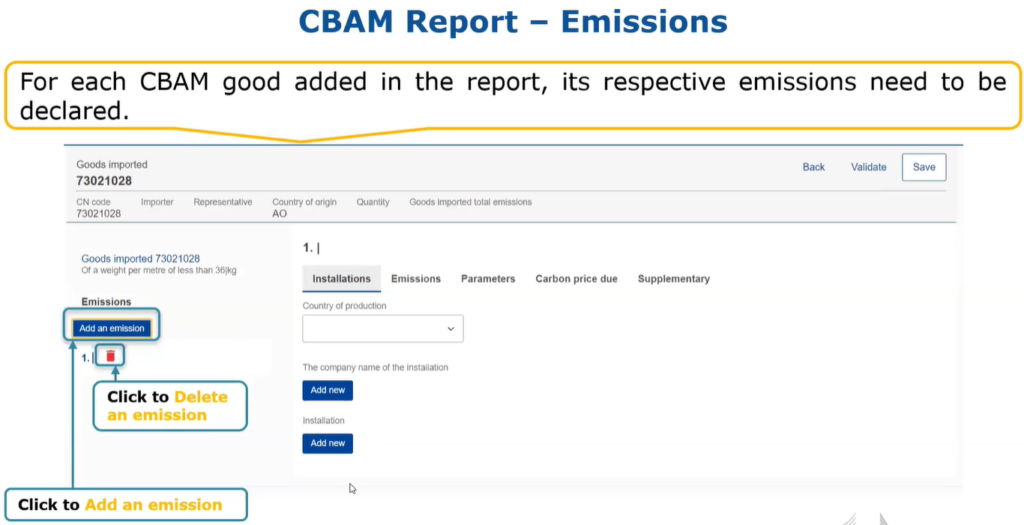

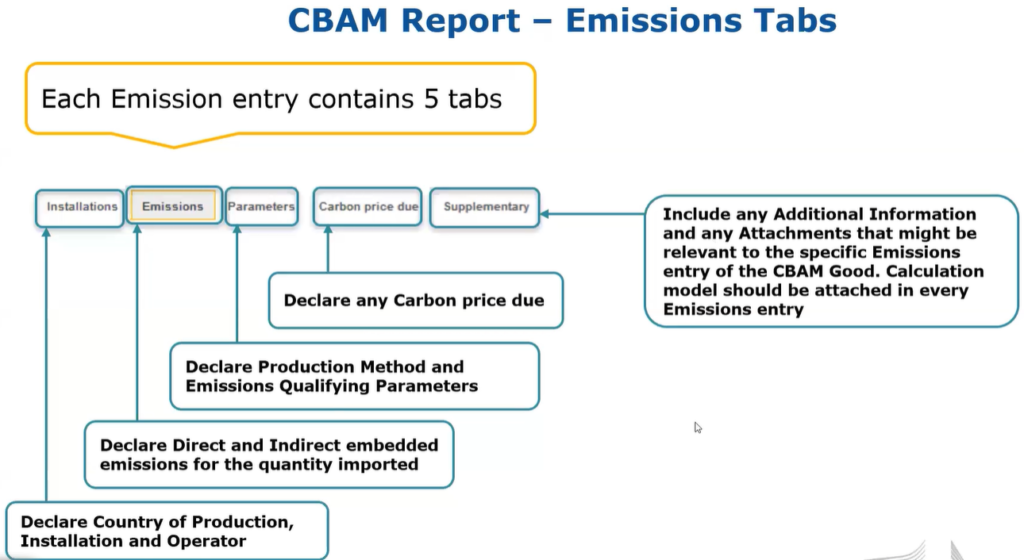

6. Under each CBAM imported goods (CN code), declare its embedded emissions by clicking the add an emission button.

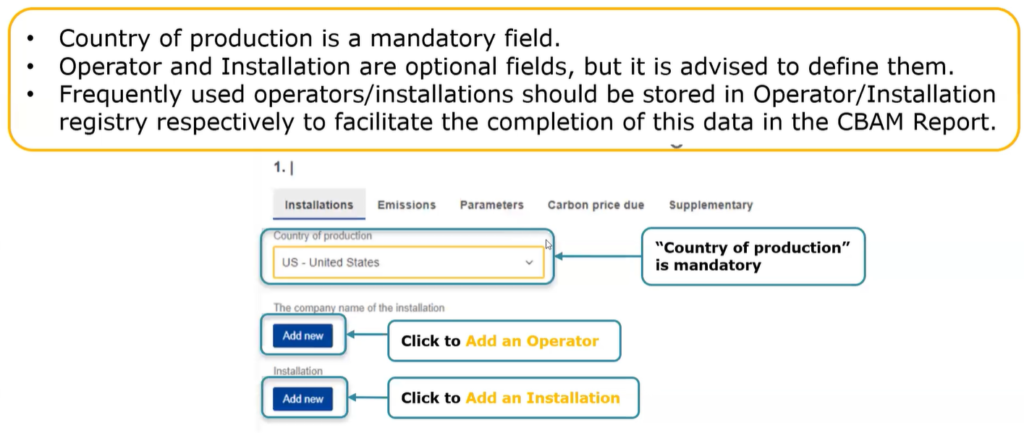

7. If you are using default values from EU Commission, Installation and Operator are optional to declare, do not click add new. It is mandatory to report Country of production. It could also be found in the customs declaration report or from your supplier.

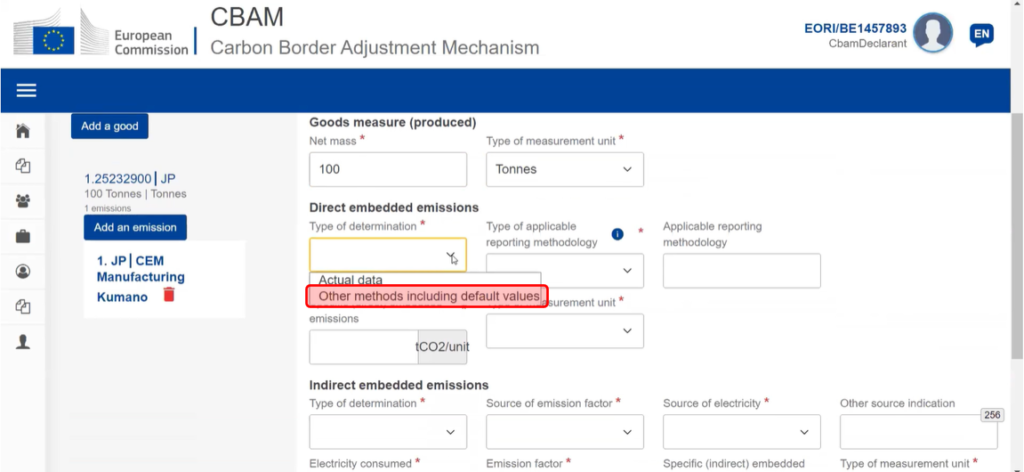

8. Click on Emissions button to report CBAM goods’ embedded emissions using default values.

9. Under Direct embedded emissions type of determination, click on Other methods including default values as shown in the red box below. Then put the default value that appears on the header into the specific embedded emissions . Repeat the steps for Indirect embedded emissions.

10. Since you are using default values and still collecting information on the qualifying parameters, carbon price paid in third countries and suppliers’ calculation methodology report. You would probably have to skip those tabs for now.

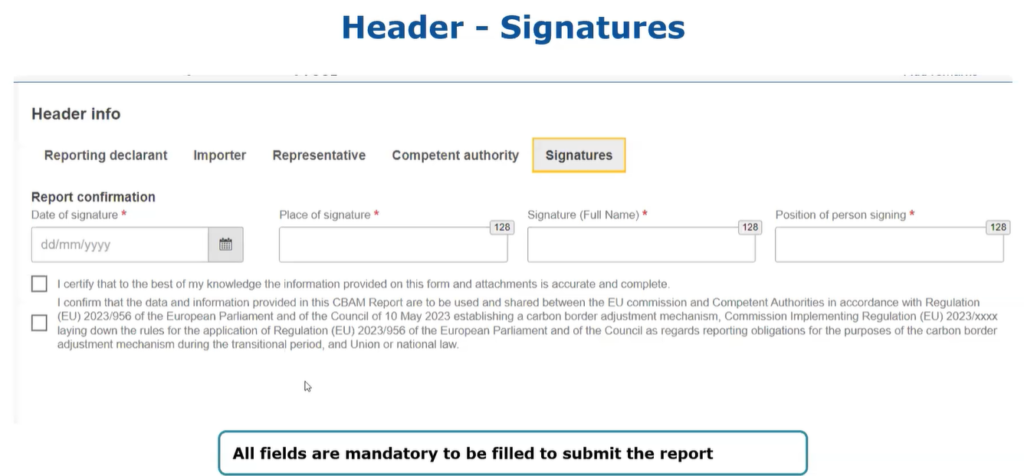

11. Add your signature under the signature tab to complete the CBAM report

In summary, for the 4th quarter of 2023 CBAM report, you can use the default values provided by the EU Commission. However, it is essential to start collecting suppliers’ CBAM goods embedded emissions now to comply with the upcoming changes in reporting requirements. Vis-map will be able to help you stay ahead of these changes to ensure a smooth transition and maintain compliance with CBAM regulations. This will give you an edge over your competition.

For a better understanding of CBAM impact on your trading business in future, feel free to use our Free to use CBAM Calculator to analyze and evaluate your business decisions.

Visit our Vis-map CBAM console to find out more on our solution.